A court in Singapore has started issuing sentences in a high-profile case involving 10 Chinese nationals.

They were charged with laundering $2.2bn (£1.8bn) obtained from criminal activities conducted overseas.

A scandal has implicated several banks, property agents, precious metal traders, and even a top golf club. Extensive raids were conducted in some of the most affluent neighbourhoods, resulting in the seizure of billions in cash and assets by the police. Singaporeans have been captivated by the sensational details – a staggering number of assets were confiscated, including numerous properties, vehicles, luxury bags and watches, an extensive collection of jewellery, and a vast quantity of alcohol.

In a recent development, Su Wenqiang and Su Haijin have been sentenced to jail, marking a significant milestone in the case. According to authorities, Su Haijin attempted to escape arrest by leaping from a second-floor balcony of a residence. Both individuals will be sentenced to slightly over a year in prison, following which they will be deported and prohibited from reentering Singapore. There are still eight others who are waiting for the court’s decision.

As it nears its conclusion, the case – the largest of its kind in Singapore – has naturally sparked inquiries. Prosecutors revealed that the funds funding their luxurious lifestyles in the country were derived from illicit sources abroad, including scams and online gambling.

How were these individuals able to reside and conduct financial activities in Singapore without attracting attention, despite possessing multiple passports from countries like Cambodia, Vanuatu, Cyprus, and Dominica? Recent developments have prompted a thorough examination of policies, leading banks to implement stricter regulations, particularly for clients with multiple passports.

Of utmost significance, the case has brought attention to the country’s challenge of accommodating the ultra-rich, while avoiding becoming a hub for illicit wealth.

Display the funds

Singapore, often compared to Switzerland in terms of its financial sector, began attracting banks and wealth managers in the 1990s. The economic reforms in China and India started yielding positive results, and during the 2000s, Indonesia also experienced a period of stability and economic growth. Before long, Singapore emerged as an attractive destination for foreign businesses, thanks to its investor-friendly laws, tax exemptions, and various incentives.

Today, the wealthy have the privilege of arriving at Singapore’s private jet terminal, indulging in opulent quayside neighbourhoods, and participating in the world’s inaugural diamond trading exchange. Located just outside the airport is Le Freeport, a highly secure vault offering tax-free storage for a wide range of valuable items such as fine art, jewels, wine, and more. The $100m-facility is frequently referred to as Asia’s Fort Knox.

Singapore’s asset managers attracted a significant influx of S$435bn from overseas in 2022, nearly doubling the amount recorded in 2017, as reported by the country’s market regulator. A significant number of family offices in Asia have chosen Singapore as their base, as revealed in a report by consulting firm KPMG and family office consultancy Agreus.

Notable individuals in this group consist of Google co-founder Sergey Brin, British billionaire James Dyson, and Chinese-Singaporean Shu Ping, who is the head of the world’s largest chain of hotpot restaurants, Haidilao.

According to authorities, there are potential connections between some of the individuals involved in the money laundering case and family offices that received tax incentives.

“Singapore faces a complex challenge,” remarks Chong Ja-Ian, a non-resident scholar at Carnegie China. The country takes pride in its reputation for clean and efficient governance, yet it also aims to attract and manage significant wealth by providing benefits like low taxes and banking confidentiality.”

“The potential for individuals with questionable sources of income to enter the banking industry is increasing.”

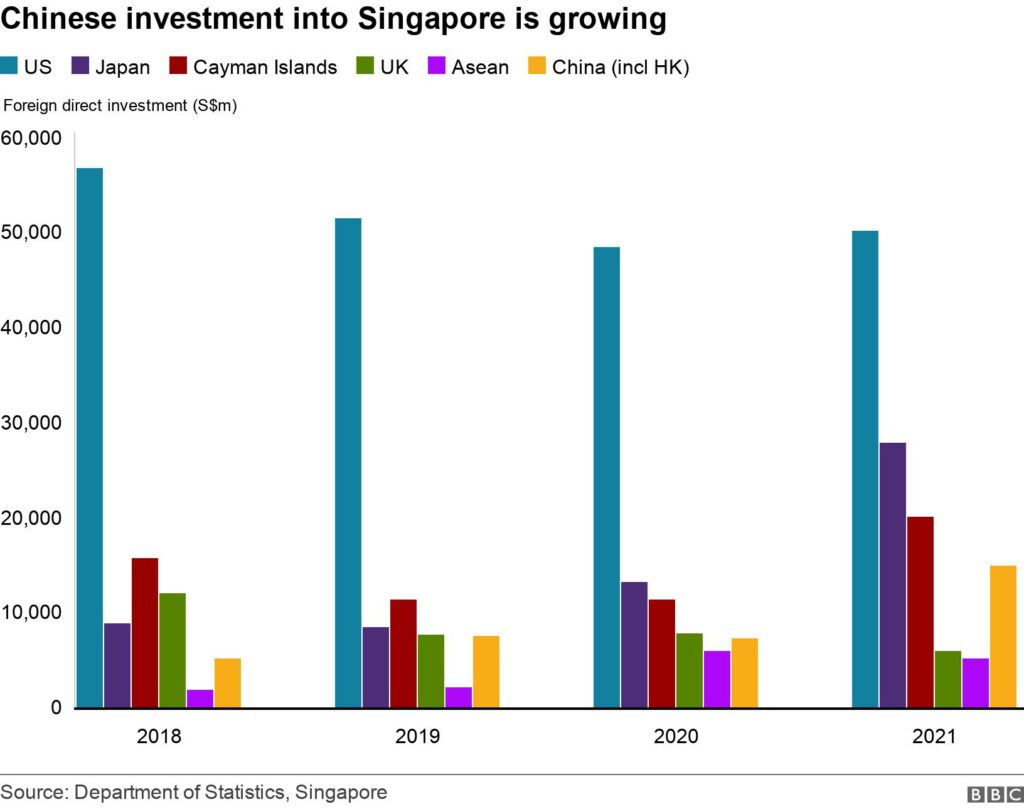

Many affluent individuals from China prefer Singapore due to its well-regarded governance and stability, along with its strong cultural ties to China. There has been an increase in Chinese investments flowing into Singapore in recent years.

One of the 10 suspects in this case has been sought by Chinese authorities since 2017 for his alleged involvement in online gambling. According to prosecutors, he chose to settle in Singapore as a means of seeking safety from the Chinese authorities.

Camouflaged in everyday surroundings

It is not the first instance where Singapore-based banks have been involved in a financial wrongdoing. Their involvement in the cross-border laundering in the 1MDB scandal, where billions were misappropriated from Malaysia’s state investment fund, has been uncovered. Dan Tan, who had significant business connections in Singapore, was previously referred to by Interpol as the head of a highly infamous match-fixing syndicate. He was apprehended at this location in 2013.

The country has stringent regulations aimed at addressing white collar crimes and actively participates in the Financial Action Task Force, a global organisation dedicated to combating money laundering and financing for terrorist networks. In recent years, banks have made significant investments to enhance compliance measures, thoroughly vet potential customers, and actively engage with regulators regarding the reporting of any suspicious transactions. However, there are no guarantees.

Firstly, regulators face challenges in identifying suspicious cases amidst a large number of high-value transactions.

“It’s not simply a single needle lost in a multitude of haystacks,” remarked Josephine Teo, Singapore’s second minister for home affairs, during her address to parliament in October of last year.

Some experts have pointed out that Singapore’s property market is often used as a means to “clean” illicit funds. Additionally, you’ll find a variety of casinos, nightclubs, and high-end stores.

“Singapore’s banking system handles significant sums of money on a daily basis. According to accounting professor Kelvin Law from Singapore’s Nanyang Technological University, criminals have the ability to take advantage of this feature and hide their money laundering activities within legitimate ones, as he explained to the BBC.

In Singapore, there are no restrictions on the amount of cash that can be brought into or taken out of the country. However, if the sum exceeds S$20,000, a declaration is required. According to Christopher Leahy, the founder of Singapore-based investigative research and risk advisory firm Blackpeak, this is seen as a positive aspect.

“If you want to move large sums of money, you can discreetly do so in Singapore, which is known for its favourable financial environment.” According to him, there is little to spend money on in the Cayman Islands or the British Virgin Islands.

When questioned about analysts’ remarks on Singapore’s appeal as a financial hub for illicit funds, authorities referred the BBC to an interview with the law and home affairs minister in a local newspaper from last year.

“Closing the window would prevent legitimate funds from coming through, so we need to keep it open.” And conducting legitimate business also becomes quite challenging. “We need to exercise good judgement,” K Shanmugam said.

“When you achieve success as a major financial centre, a significant influx of money is inevitable. Along with that, there may be some individuals who are attracted to the opportunities,” he mentioned, alluding to a famous quote by the late Chinese leader, Deng Xiaoping.

According to Dr Chong of Carnegie China, Singapore is facing a decision regarding its stance on accepting questionable funds.

According to him, the main challenge lies in promoting transparency rather than relying solely on increased regulation. He believes that transparency contradicts the discreet nature of wealth management hubs, which is crucial for their success.

According to some analysts, this could be seen as a necessary cost for Singapore to maintain its status as a leading financial hub.

“The majority of the funds are legitimate, after all,” Mr. Leahy states. “However, there is an unavoidable price associated with being a prominent financial hub.”

More Stories

Meet the richest Family in the World, who Possess 700 Cars and Live in a $478 Million Home

Joshlin Smith: The Disappearance of a Six-year-old in Saldhana Bay, South Africa, has Caused Panic

Princess Charlotte turns 9 in this New Snapshot