A new mortgage option is now available in the UK, offering significantly lower rates.

This is great news for individuals who have been facing difficulties in purchasing their first home.

Deciding to purchase your first home is a significant milestone. However, in a challenging economic climate marked by soaring inflation and increased costs in various sectors, such as fuel and food, saving money has become increasingly difficult.

Introducing a new mortgage deal that provides an opportunity for individuals to bid farewell to renting and finally purchase their very own flat or house with a 99% mortgage.

You’ll only need to invest £5,000. A significant shift from a market where mortgages with an interest rate of five per cent are commonplace.

In simpler terms, a house valued up to £500,000 would only require £5,000. In a 5% scheme, you would require an amount of £25,000, which is five times the initial investment.

Who is responsible for this?

Yorkshire Building Society is offering a deal to the open market, specifically targeting first-time home buyers.

The new mortgage will be accessible throughout England, Scotland, and Wales, and can be obtained through Accord Mortgages, the lender’s intermediary-only division, with the assistance of brokers.

For someone purchasing their first property for £200,000, a £5,000 deposit would amount to 2.5% of the purchase price.

The remaining 97.5% would be allocated towards a mortgage.

What is the reason behind its introduction?

According to Ben Merritt, the director of mortgages at Yorkshire Building Society, their research suggests that an amount of £5,000 could potentially reduce the time required for first-time buyers to become mortgage-ready.

According to him, it may be beneficial to promote fairness for individuals who lack financial assistance from their families.

As part of this special offer, eligible first-time buyers have the opportunity to secure a five-year fixed-rate mortgage at 5.99%, provided they have a minimum deposit of £5,000.

Who can benefit from this opportunity and what are the conditions?

Individuals who have never owned a house previously. At the end of the mortgage term, there is an age limit in place, which is set at 70.

The mortgage is not offered for new-build properties or flats, and the society mentioned that loans undergo thorough credit scoring and affordability checks.

According to Mr Merritt, it is important to note that even though £5,000 may only be a 1% deposit for those seeking the maximum loan amount, customers are still required to contribute to a deposit. Additionally, they must meet strict criteria such as having a strong credit history and passing an affordability assessment in order to qualify for a £5,000 deposit mortgage.

“We have a duty to encourage financial responsibility in anyone taking out a mortgage.”

How Brits can qualify for new mortgage scheme where you need just £5,000 deposit to buy a house

A groundbreaking mortgage scheme is poised to help countless individuals who are facing difficulties in transitioning from rented accommodation to the housing market.

Amidst soaring inflation rates and persistently high interest rates, the past few years have proven to be challenging as the cost of living crisis affects individuals in various ways.

For individuals interested in purchasing their first house or flat, the recent fluctuations in cash value have created a challenging and uncertain situation.

However, thanks to a new scheme offered by Yorkshire Building Society, it is now possible to enter the property market with a mere five thousand pounds in your household’s savings.

This implies that instead of requiring the usual 5% of the property value as a mortgage deposit, you only need £5,000 for any property valued up to £5,000.

Can you explain the process?

Let’s approach it from a practical standpoint.

With just a small deposit of £5,000, you can secure a home valued at £350,000.

On the other hand, the amount would be £17,500 for a 5% scheme or £35,000 for a 10% scheme.

It will result in an increase in your mortgage, potentially leading to higher monthly repayments.

According to the terms, individuals who have a deposit of at least £5,000 have the opportunity to secure a five-year fixed-rate mortgage at 5.99%. There are opportunities to benefit from purchasing in England, Scotland, and Wales.

How can one apply for the £5,000 mortgage scheme?

It’s clearly not accessible to everyone.

First and foremost, it’s important to consider purchasing your initial property, which is not surprising considering it’s a program designed for first-time buyers.

Additionally, it is important to note that there is an age limit of 70 for the conclusion of your mortgage agreement.

So basically, if it’s a 25 year mortgage agreement. The maximum age to enroll in the scheme is 45.

What can the program be used to purchase?

It’s not just any property.

Unfortunately, the Yorkshire Building Society scheme does not cover the purchase of new-build houses or flats.

Just like any mortgage, loans undergo thorough credit scoring and affordability checks.

And what if you’re facing challenges but have a strong desire to make progress?

There are many other banks and building societies that are also making efforts to assist those who wish to purchase a property.

Skipton Building Society offers a unique mortgage option known as the ‘track record’ mortgage. This program offers assistance to renters looking to transition to homeownership, potentially eliminating the need for a deposit (subject to terms and conditions, of course).

Skipton utilizes borrowers’ rental payment history to determine their potential borrowing capacity.

Certain lenders also provide options where family members can use their savings as collateral for a specific duration, like Barclays’ family springboard mortgage.

1% vs 0% deposit mortgage: what’s the difference and which should you go for

Finally securing a mortgage can be an exhilarating experience, as everything needs to fall into place to ensure a smooth and successful deal.

It is crucial to generate sufficient income to cover the monthly repayments, especially during a time when interest rates are consistently above five percent.

And it’s important to ensure that your income is sufficient to cover the cost of a property, typically limited to 4.5 times your salary. That is also why being in a long term relationship is crucial for many – the combined income greatly simplifies things.

Recently, Yorkshire Building Society (YBS) introduced an exciting 1% mortgage scheme, allowing individuals to purchase a home valued at up to £500,000 with just £5,000.

It’s anticipated to be a significant assistance for numerous individuals, as the traditional requirement of a 5% to 10% deposit becomes a distant memory for those struggling to save during a cost of living crisis.

But is it the most advantageous option for you? You may have also come across zero percent mortgages, which allow you to secure a brand new house or flat without having to make any upfront payment.

Benefits of a 1% deposit mortgage

As previously mentioned, YBS has introduced a new scheme offering the opportunity to purchase a property for just five grand.

One of the advantages of a one per cent mortgage is that it allows you to purchase a house with less cash and enter the property market sooner. This can be particularly beneficial if you plan on upgrading to a ‘better’ property as your financial situation improves over time.

You can also generate income by accumulating equity in your home. If the value of your house surpasses your mortgage, you get to keep the extra funds. It can amount to a significant sum if the property market experiences a surge.

Drawbacks of a 1% deposit

You may face higher interest rates when applying for a mortgage with a small deposit, as banks and building societies consider it a riskier proposition.

They will perceive you as a greater risk if you invest a smaller percentage, such as five or ten percent.

By offering a 10% deposit at this time, you could potentially secure an interest rate of 3.41 per cent, as per our findings on TotallyMoney.com. For a house valued at £250,000, the monthly payment would amount to £1,159. So if you decide to contribute only one percent, be prepared for the monthly payments to be quite substantial.

Another concern arises when the value of your house decreases from its original purchase price, commonly referred to as negative equity.

In this scenario, selling may only be possible if your mortgage provider grants permission, as they could potentially receive a reduced amount of cash. You won’t receive any ownership stake from the process.

Advantages of a mortgage with 0% deposit

If you opt for a zero per cent deposit mortgage deal, there will be no need for you to make any payments. They are sometimes referred to as a no-deposit mortgage.

There are some expenses involved in the process, including legal fees, surveys, mortgage fees, and potentially stamp duty, depending on the property’s value.

In the aftermath of the 2008 financial crisis, the Financial Conduct Authority (FCA) implemented stricter regulations on banks’ zero per cent schemes. The aim was to ensure that individuals could genuinely afford their repayments and to minimize the number of repossessions.

According to CompareTheMarket, obtaining a zero per cent scheme can be quite challenging. It states: “No deposit mortgages are not as common as they used to be, although a few lenders still provide them.” If you’re interested in obtaining a 100% mortgage, it may be beneficial to consult with a mortgage broker. They can assess the various mortgage options available and determine if any are currently being offered. If you come across a mortgage that doesn’t require a deposit, it’s probably either a guarantor mortgage or a family deposit mortgage.

Similar to the availability of one percent mortgages, the amount of money required to enter the housing market has significantly decreased.

And in the event of a property market surge, you’ll find yourself with additional funds from the increased value of your home.

Drawbacks of a 0% deposit mortgage

Just like other schemes, it’s important to be aware that higher interest rates may be involved.

Increasing your deposit amount often results in more favorable interest rates offered by banks or building societies.

One potential risk to be aware of is negative equity, which can be a concern when participating in a one percent scheme.

What’s the verdict?

Both are quite alike. According to numerous experts, it is advisable to steer clear of both options if possible.

Having a substantial deposit is crucial when it comes to securing a favorable mortgage deal.

If you are unable to afford one, it may indicate that you are not currently in a favorable financial situation to undertake a significant amount of debt, which is essentially what a mortgage entails.

Peter Stimson, head of product at MPowered Mortgages expresses his concerns about one percent deposit mortgages. It’s yet another attempt that is bound to be unsuccessful.

“Given the minimal deposit required, the cost of these mortgages will be determined by the level of risk involved, resulting in significantly higher expenses.”

“Instead, it is crucial for the Government to prioritize addressing the underlying problem, namely the shortage of available housing and the need for affordable options.”

In our view, this mindset can be applied to zero and one percent schemes.

Why banks don’t accept proof of paying rent for people to get a mortgage

The process of buying a house can be quite overwhelming. And for those experiencing it for the first time, it can be quite overwhelming.

However, for many, the prospect of owning a home can seem unattainable due to the challenges associated with obtaining a mortgage. These challenges may include high upfront deposit costs or the need to earn a significant income to afford a property that is approximately four times your household income.

Many individuals who are eager to transition from renting to owning a house or flat often wonder why their years of paying high rent rates don’t contribute towards their ability to buy a property.

There is exciting news for potential first-time buyers in the UK, as a new mortgage option has been introduced. With just £5,000, it is now possible to secure a home worth up to £500,000.

The average monthly rent in the UK is currently £1,276, which exceeds the mortgage repayments of certain individuals.

In 2022, a YouGov poll revealed that a significant majority of Brits expressed the view that banks and other lenders should take into account a person’s renting history as evidence of their ability to repay a mortgage.

However, the situation is more complex than it seems, and banks have their own justifications for disregarding a rental history when it comes to purchasing a house.

Have you ever wondered why banks don’t consider rent as a valid indicator of your ability to afford a mortgage?

According to LandlordZone, those who provide mortgages must adhere to the regulations set by the Financial Conduct Authority (FCA).

The FCA considers various factors such as income and deposit payments when assessing mortgage applications. These rules are in place to ensure that borrowers can continue to afford their mortgage repayments, especially in times of rising interest rates, which is particularly relevant during periods of inflation.

“Owning a house comes with additional expenses, unlike renting where the landlord takes care of all repairs. Repairs, maintenance, buildings and contents insurance are expenses that many renters are not burdened with.

“When considering the expenses of a long-term mortgage, it’s important to take into account the 25-year duration, which presents a different set of challenges compared to short-term renting.”

“It’s unfortunate that many mortgage lenders don’t consider a person’s consistent rent payments as a reliable indicator of their ability to afford a mortgage.”

What are the extra expenses that homeowners need to cover?

Home insurance is a necessary legal requirement if you’re seeking a mortgage. Individuals who make a deposit of less than 20 percent will be required to pay for private mortgage insurance as well.

Additionally, the council tax can be covered by your landlord if you’re renting.

Additionally, it’s important to consider the maintenance and repair responsibilities that come with owning a property, as opposed to renting from a landlord.

In 2017, Parliament discussed the matter of rent payments not being considered when applying for a mortgage.

During his speech, Paul Scully MP expressed his surprise at the lack of attention this issue had received in the past.

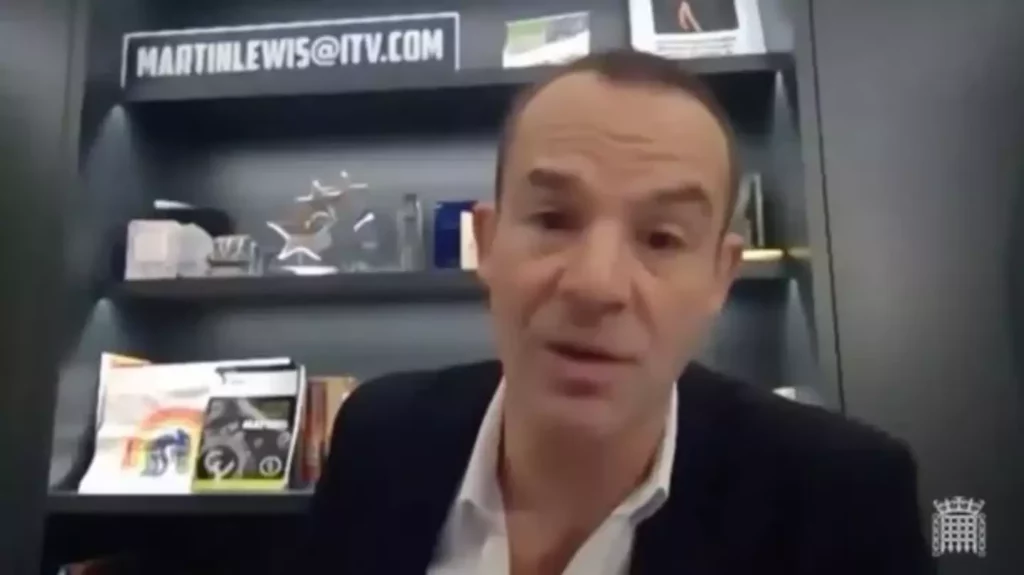

Martin Lewis warns first time buyers need to be ‘cautious’ over new deposit-free mortgage scheme

Money-saving expert Martin Lewis advises first-time buyers to exercise caution when considering the latest deposit-free mortgages available.

Attention was captured throughout Britain yesterday (9 May) with the announcement from Skipton Building Society of its ‘industry-first’ Track Record Mortgage. This innovative mortgage aims to provide an opportunity for renters to enter the property market, even if they haven’t saved up a deposit.

If the customer meets specific criteria set by Skipton, such as being a first-time buyer over the age of 21 with a proven track record of good rental history, they may be eligible to borrow the entire cost of the home.

The information seemed almost too good to be true for many renters, who have faced difficulties in saving up for a deposit because of the high monthly rent expenses. But what is the opinion of our reliable money-saving expert?

Lewis issued a statement in response to Skipton’s latest mortgage announcement, expressing his longstanding support for improved assistance for buyers. However, he emphasized the significance of being well-informed about the commitments involved.

“I’ve been advocating for years to assist mortgage prisoners trapped in unaffordable rates, and the possibility of 100 percent mortgages making a comeback evokes conflicting emotions,” Lewis expressed.

“Years of indulging in real estate fascination Television programs often promote the notion of purchasing a house as quickly and as large as possible. However, it is crucial to prioritize not overextending your financial resources.

“In the past, banks used to be less cautious and would grant mortgage loans to almost anyone. However, after the 2007 financial crash, we have learned the importance of being more careful.”

Skipton has recognized the importance of caution when providing mortgages, as stated by Charlotte Harrison, CEO of Home Financing at Skipton. She assures that the mortgage has been designed with the specific challenges faced by the generation of renters in mind.

“By prioritizing these challenges, we have carefully incorporated measures to address negative equity,” she stated.

Lewis praised Skipton’s criteria of demanding a solid rental track record to demonstrate the capability of making mortgage payments as a ‘sensible’ approach. Consequently, he expressed a ‘cautious welcome’ towards the mortgage.

However, he emphasized that this would only be available to a select few and expressed support for it as long as it is implemented with caution.

“I cautiously embrace it, when approached with care and after seeking advice, as a potential choice for certain individuals,” Lewis said.

More Stories

Trial for Rape and Human Trafficking will take Place in Romania for Andrew Tate and his Brother Tristan

A British individual tests the first Customised Melanoma Vaccination

Gaza Baby Delivered from Dead Mother’s Womb Perishes